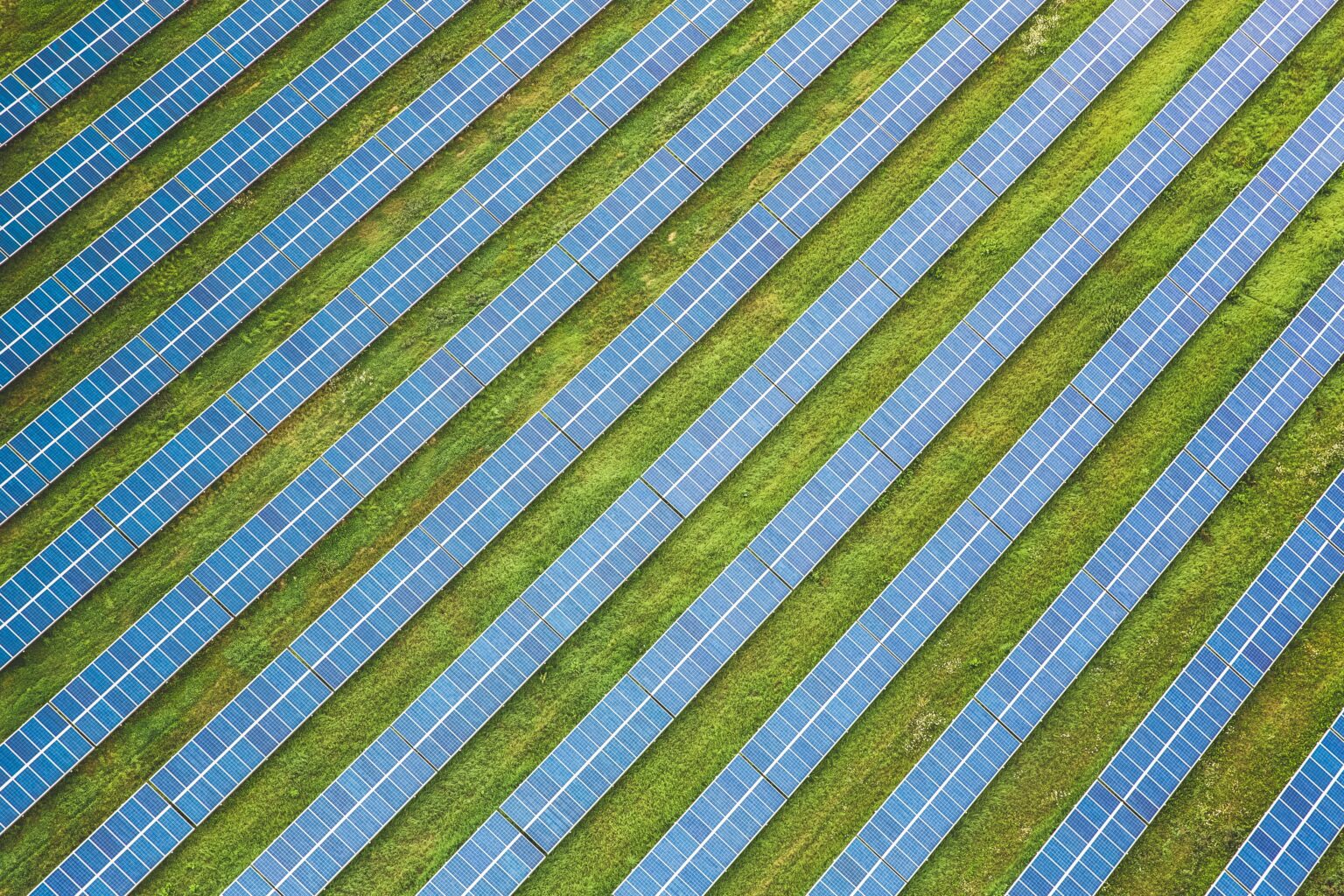

The world is in the midst of a worldwide crisis: the global warming. Greenhouse gases are the biggest drivers of climate change, one of which is carbon dioxide. The combustion of coal, crude oil and even natural gas for energy produces carbon dioxide and therefore highly contributes to global warming.

At the same time, energy demands are as high as ever and rising with increasing industrialization. Moreover, the reserves of natural resources, especially crude oil, are coming to an end. In a nutshell: renewable energy is one of the most relevant topics in the (near) future.

This of course accounts for the investment field, in which renewable energy is an important topic. Europe is home to many of renewable energy investors, specifically home to a lot of solar energy investors. Investing not only in Europe but world wide, European solar investors have a leading role in the worldwide energy transition. This article presents 10 of the leading solar energy investors from Europe.

1. Octopus Renewables (London, UK)

Octopus Renewables is a company you can’t get around in the renewable energy sector. Since 2010 the London-based investor became on of the most important solar investors in Europe, in addition to their important standing for wind energy investments. Investing mainly in the Europe, octopus renewables now has a total of 2.8 GW of total portfolio capacity (including wind energy). The surface area of installed solar parks accounts for 1,644 football stadiums. Solar energy makes up just over 30% of the renewable energy investors portfolio.

2. Cubico sustainable investments (London, UK)

Cubico sustainable investments is also a London-based renewable energy investor. Founded in 2015, the company has worked its way up to the top in only 6 years and accounts as one of the world leading investment firms for solar and wind energy. Cubico invests in solar photovoltaic as well as solar thermal energy, mainly in Europe and in the Americas. Overall, the England-based solar investor is active in 12 countries and has installed over 4.2 GW energy.

3. Aurea capital partners (Majadahonda, Spain)

Aurea capital partners is a Spain-based investment manager with their focus on risk-adjusted and sustainable returns. Aiming for a diversified portfolio, Aurea is active in various renewable energy assets all over Europe with Solar investments being one of the most important Investment areas of the investment manager. The 2013-founded company is also interested in renewable gas and is active in the development of solar parks and renewable gas projects.

4. Encavis AG (Hamburg, Germany)

The German renewable energy investment and asset manager Envacis AG is based in Hamburg. The Encavis AG is the largest German solar park operator listed on the stock market and therefore highly relevant for the energy transition in Germany but also in Europe, as the manager is active in various European countries. Established in 2018 from the merger of Capital Stage AG und der CHORUS Clean Energy AG, Encavis now focusses on investments in solar energy as well as wind energy which later stay in the company as Encavis is active in operating as well.

5. NextEnergy Capital (London, England)

NextEnergy Capital is a renewable energy investor with a clear focus on solar energy. Since their founding in 2007, the investor has built up a portfolio of 1425 MW of installed capacity in 7 countries. Their geographical focus lies mainly in the United Kingdom as well as in Italy – with a total 324 solar plants invested in. Therefore NextEnergy Capital, which headquarters is in London, belongs to one of the most important solar investors in Europe. Moreover, the renewable energy player is also active as a developer with their subsidiary NextPower Development (NPD) since the beginning.

6. Sonnedix (Saint Grégoire, France)

Sonnedix is, as the name already suggests, a French solar investor. Sonnedix is also active in various other steps in the value chain, such as developing and building. The independent power producer (IPP) was founded in 2009 and now has 1.6 GW installed capacity with a total controlled capacity of 4.2 GW solar energy. Most solar projects are in Europe’s sunniest countries: Spain and Italy, where the geographical focus of the solar energy investor is. Sonnedix is globally present and also owns solar projects in the United Kingdom, in South Africa, in Japan, in Puerto Rico and in Chile.

7. A2A (Brescia, Italy)

Aside from asset investors or managers, utility investors also play an important role in the renewable energy market. A2A is an italian renewable energy company that generates, distributes, and markets the later. Oriented on the European goals for the energy transition, the Brescia-based solar investor plans to achieve 5.7 installed GW by 2030. Their geographical focus is mainly in italy but A2A also plans to invest & develop solar and wind projects all over Europe.

8. Finerge SA (Matosinhos, Portugal)

The Matosinhos-based Finerge is an investor active in their home country Portugal as well as Spain. Investing in the renewable energy assets wind and solar, Finerge now has a portfolio of 53 wind farms and 16 photovoltaic solar plants which in total accounts for 2.4 GW of installed capacity. The shareholder of the investor is First Sentier Investors, a global asset manager that established Finerge in order to improve their standing in the renewable energy market.

9. SUSI Partners (Zug, Switzerland)

The Swiss-based SUSI Partners was founded in 2009 and has around 1.5€ Mrd. assets under management. Believing in the necessity of the shift away from fossil fuels, SUSIs main focus is the investment in solar energy as well als wind energy to promote renewable energy. Moreover, the private fund manager is interested in battery storage projects and recently invested in multiple storage projects in the United Kingdom. From their headquarter in Zug, Switzerland, SUSI operates globally.

10. Omnes Capital (Paris, France)

Omnes Capital is a Paris-based investor in private equity and infrastructure. With around 5€ billion assets under management and about 13 years of experience in the European renewable energy market, Omnes has achieved a portfolio containing over 4 GW installed capacity. Their portfolio is highly diversified and includes in investments in solar, wind and hydro energy. With their focus market in Europe, the investor has gained a leading role and owns energy projects all over France, German, Italy, Spain, Belgium or the Nordic countries.

Image Source: Unsplash, 20.05.2021