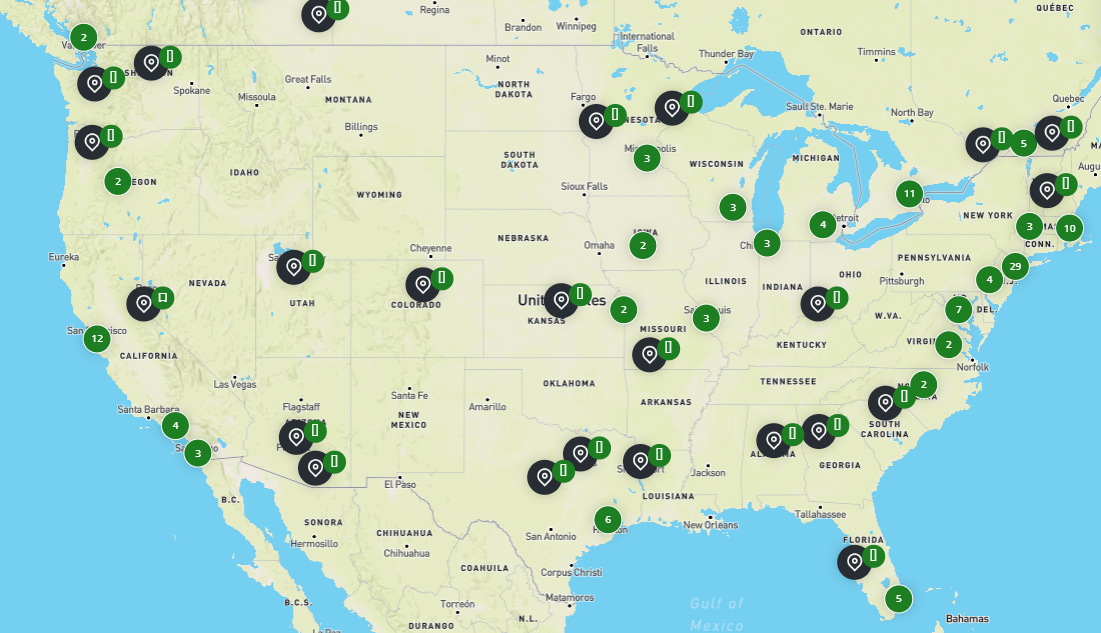

List of the 100 largest renewable energy investors in the United States [2024]

€249,99 excl. VAT

Get access to our list of the most important renewable energy investors from the United States (like etc.) as an excel file for 249,99€. Investors finance renewable assets like solar parks and wind farms. The list includes further information (like executives’ names, contact details, etc.). The list includes free-of-charge updates and additional entries for one year, sent out via email.

Last update: 20th of February, 2024

For a free preview please contact: hello [at] renewables.digital

Description

List of 5 renewable energy investors in the United States

1) NextEra Energy (Juno Beach, Florida, United States)

With $20 billion in investments in renewable energy in 2019, NextEra Energy is one of the largest utility investors in the United States and headquartered in Juno Beach, Florida. As a publicly-traded company (NYSE: NEE) it invests in offshore wind, solar, and energy storage projects across North America. Since its founding in 1984, NextEra Energy’s investment portfolio has reached a total capacity of over 21 GW with 150 wind and solar energy centers in various states throughout the United States and Canada.

2) Greenbacker Capital (New York City, New York, United States)

The New York-based investment manager Greenbacker Capital was founded in 2011 and, since then, has carried out investments summing up to $1.460 billion. The company’s investment portfolio comprises onshore wind, solar, and storage projects across North America. Greenbacker Capital’s investments have generated an installed capacity of 250 MW of renewable energy. Recently, the company acquired a wind farm in California that will provide 57.5 MW of clean energy to households.

Update 2024: In Q3 2023, the company acquired three solar projects in southwestern Colorado from OneEnergy Renewables. Currently, it has more than 115MWdc of solar energy projects in Colorado, aiming to expand further. Moreover, Greenbacker Capital acquired four solar farms in Minnesota and in Wisconsin from OneEnergy Renewables as well.

3) MidAmerican Energy (Des Moines, Iowa, United States)

MidAmerican Energy is an utility investor based in Des Moines, Iowa. In the last twenty-five years the company has carried out investments of $1300 million. These investments are in wind and solar energy and are mostly in Iowa, but also in Illinois, South Dakota, and Nebraska. In 2020, 83.6% of the company’s Iowa customers used energy created through renewable energy sources.

4) Alliant Energy (Madison, Wisconsin, United States)

The Midwest energy provider is a publicly-traded (NASDAQ: LNT) utility investor and based in Madison, Wisconsin. With 4,000 employees, the company serves more than 950,000 households. Since its establishment in 1917, Alliant Energy has invested in onshore wind, solar energy, and storage projects summing up to a portfolio with an installed capacity of 1800 MW of renewable energy. Moreover, Alliant Energy has $17 billion in assets under management.

Update 2024: In development since 2022, Alliant Energy has completed its Wautoma Solar Project, a 99 MW solar array in the Waushara County town of Dakota, US.

5) LS Power Development, LLC (New York, United States)

The New York based LS Power Development is is a development, investment and operating company focused on the energy infrastructure sector. The company was founded in 1990, and since then, LS Power has developed and invested in projects combining a portfolio of 13 GW. The investment manager has over $10 billion in equity capital and invests in the North American power and energy infrastructure sector, such as onshore wind farms, solar parks or energy storage projects.

Research for our directory of American investors with a renewable energy portfolio

The list of American renewable energy investors underlies an ongoing research process: our team screens transactions, analyzes new projects, and cooperates with various investors and project developers in the renewables industry. Through our state-of-the-art crawler technology, the list is updated and extended multiple times per year. All entries that are included in the list can also be retrieved through our online database. In case we missed an important investor, please submit it here.

Finding the right investors for solar and wind parks in the United States

A popular use case of our list is the identification of relevant investors for solar / PV and wind parks in North America. The handy list – delivered as an excel file – can be filtered according to your criteria. For instance, with just a few clicks you can identify all PV park investors that are active in North America. Or: all offshore wind park investors that have their headquarters in California. We screen every news report regarding transactions of renewable assets. Hence, our excel list gives a unique overview of renewable investors.

Different types of green energy investors covered

Our list mainly includes three different types of renewable energy investors: asset- and investment-managers, utilities, independent power producers and family offices. Asset managers are investing in the name of institutional investors and managing a renewables portfolio for their funds. That includes operating the portfolio, selling the energy through PPAs and on the free market, and acquiring new assets. Utilities are acquiring – and in some cases building on their own – renewable assets to ensure CO2-neutral and cheap energy supply for their customers. Family offices – the investment firms of high net worth families – recently started to invest in renewables and also to acquire wind and solar parks. Independent power producers are also investing in renewable energy projects – they function similar to a public utility without owning a power grid.

Included columns in our renewable investor database

- Company Name

- Legal form

- URL

- Country

- City

- Postcode

- Address

- Phone

- Onshore Wind?

- Offshore Wind?

- Solar?

- Hydro?

- Hydrogen projects?

- Energy storage?

- Biomass?

- Geothermal?

- Type of Investor (Asset-/Investmentmanager, Family Office, Utility, Independent Power Producer (IPP))

- Working with PPAs?

- LinkedIn contact of Management

- Founding Year

- Management

- Regional Focus

- Installed capacity in MW

Image Sources: Chuttersnap & insung yoon via Unsplash (20.09.2023)