The Italian solar market has not experienced the rapid growth seen in other southern European countries such as Spain and Portugal due to the expiration of government incentives in 2013. However, recent government policies have been implemented which will emphasize the development of the solar market. The Italian government announced their goal for 55% of the country’s power generation to be sourced from solar energy by 2030 thus, reaching 55GW of installed solar capacity. In order to prevent permit and legislation delays, a Simplification Decree was introduced in 2021 which will incentivize investors to gain a foothold in the Italian solar market.

1) Obton (Denmark)

With over 12 years of solar experience, the Arhaus-based group have been involved in over 1,300 solar projects. Obton uses this experience to identify valuable investments and use their well-founded partnerships to allow them to acquire projects. In March 2022, the Danish renewables group announced that they have raised €400m in funding for their Italian solar portfolio. The €400m will be used to develop 144 solar projects spread across Italy.

2) Capital Dynamics (UK)

The renewables arm of the independent private asset management firm was established to capitalize on the fast-growing solar and wind energy sector. Capital Dynamics are one of the largest owners of subsidy-free renewable assets in southern Europe, with a total installed capacity of 570MW. In May 2022, the investment group announced the acquisition of their acquisition of 18MW Project Cliff solar park in Sicily. The solar park was purchased from Solar Ventures and the ready-to-build site will power over 5,000 Italian homes a year once operational.

3) Aquila Capital (Germany)

The Hamburg-based investment group are one of the leading renewable investors in Europe. Since the inception of their stock-listed ALAQU company in 2001, it has amassed a portfolio containing wind, solar and hydro projects with a total installed capacity of 8GW. One of the countries of focus for the fund is Italy, a country where they have invested in numerous solar assets. In January 2022, Aquila Capital confirmed the acquisition of a 51% stake in 421MW of Italian solar projects. The large-scale portfolio was purchased from Soltec Power Holdings’ subsidiary Powertis, which will retain a 49% stake. The portfolio consists of 15 solar parks which will be developed by Powertis. This deal represents an advancement to the 772MW deal previously arranged. This will bring Aquila’s total Italian solar portfolio to 1.2GW with a further 90MW in energy storage, cementing their position as a leading Italian solar investor.

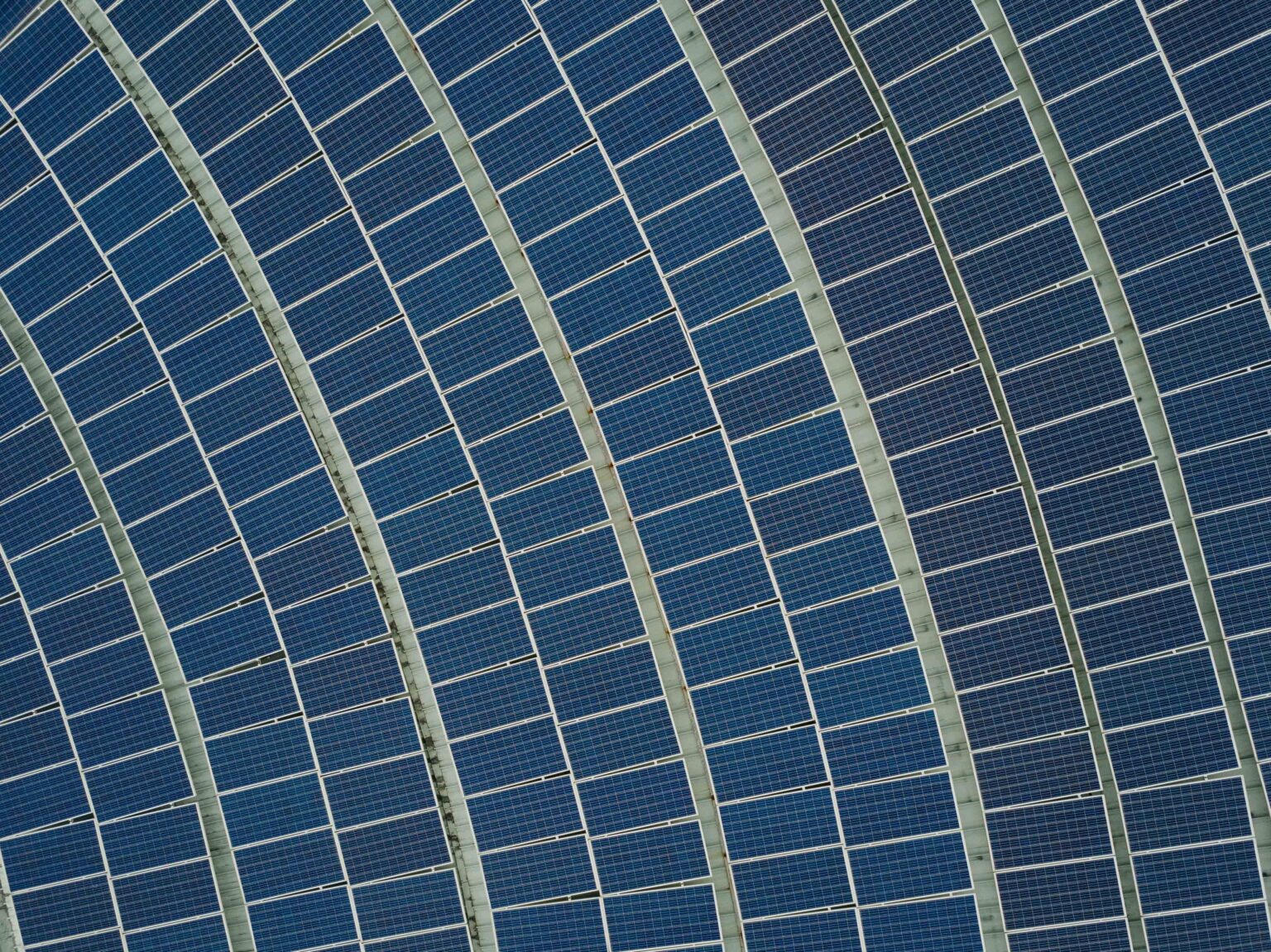

Image Source Unsplash 13.05.2022