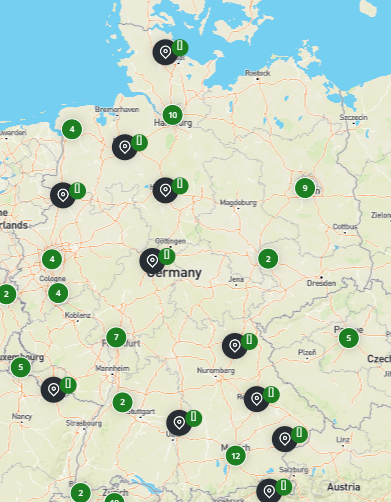

List of the 50 largest renewable energy investors in Germany [2024]

€199,99 incl. VAT

Get access to our list of the most important German renewable energy investors (like Aquila Capital or hep energy GmbH etc.) as an excel file for 199,99€. Investors are owners of renewable assets like wind parks or solar farms, being interested in acquiring new assets. The list includes further information (like executives’ names, LinkedIn accounts, contact details, etc.). The list includes free-of-charge updates and additional entries for one year, sent out via email.

Last update: 09th January, 2024

For a free preview please contact: hello [at] renewables.digital

This list is an excerpt of our List of the 350 largest renewable energy investors in Europe

Description

List of 3 large renewable energy investors in Germany

The German sustainable energy sector has grown in recent years – the goal of the Federal Republic is to draw 40 to 45 percent of the electricity consumed from renewable energy sources by 2025. Currently, the share of renewable energy in German electricity generation is about 35%. Wind power is by far the most widely used type of energy in Germany. This environment is generating a great deal of interest in the German investment sector. German energy investors are mostly active all over Europe and are interested in solar investments in warmer countries like Portugal or Spain, as well as investments in Nordic countries which have high potential in wind and hydro power. The following article presents three investors from Germany who are active in the renewable energy sector.

1. Aquila Capital (Hamburg)

Aquila Capital has its headquarter in Hamburg, Germany and is one of the most important german renewables investors with around 11€ billion under management. The investor has diversified portfolio and invests not only in the standards, solar and wind energy, but among others in hydro or green logistics. All together Aquila, which was founded in 2001, has around 10GW of renewable energy in their portfolio.

Update 2024: In January 2024, Commerzbank has obtained a 74.9% controlling interest in the German asset manager Aquila Capital. Aquila Group will retain the remaining 25.1% stake, and the completion of the deal is anticipated in the second quarter of this year.

2. CEE Group (Hamburg)

Also with their headquarter in Hamburg, CEE Group is slightly older than Aquila and was founded 2000. Over the last 20 years the investor has invested more than 1.9€ billion in wind and solar assets in central Europe. These two assets groups, photovolatic and wind energy, are the expertise of the investor. The geographical focus of the CEE Europe is in Germany, France, Sweden and the Netherlands. Also through this focus, the German renewables investor is one of the largest investor and provider of wind and solar energy in Europe.

Update 2024: CEE Group has acquired an 80.9-MWp solar project near Berlin from Chint Solar. Construction starts in February 2024. It’s the first transaction through CEE Renewable Fund 8. The fund, launched in 2023, will own 55% of the solar park, and CEE Group will hold the remaining 45%. Overall, CEE Group’s portfolio currently includes 49 solar projects (1,006 MWp) and 46 onshore wind farms (655 MW) in Europe.

3. EWE Erneuerbare Energien (Oldenburg)

EWE Erneuerbare Energien is the Subsidiary of the German Energy supply company EWE AG. The kick-off for the investor, whose first wind farm with 3MW was a very successful pilot project and the biggest windpark in Germany at the time, took place as early as 1989. Wind energy is still the company’s focus today, with 360MW of onshore wind energy complemented by 170MW of offshore wind energy. In addition to financing wind farms, EWE erneuerbare Energien is also interested in solar and biomass energy, with a combined portfolio of 14 MW.

Research for our directory of German renewable energy investors

As part of the Isar Digital Ventures Group, we have intensive research expertise. Our research team not only deep dives into transactions and deals in the European and German renewable energy market and analyzes new solar, wind or other projects, we also cooperate with various investors and project developers in the renewable energy industry. Our manual work is complemented by our state-of-the-art crawler technology, which allows us to update and extend the list multiple times per year. All entries that are included in the list can also be retrieved through our online database. In case we missed an important investor, please submit it here.

Finding the right investors for energy projects in Germany

This list is ideal for identifying investors who can invest in your project – be it potential solar parks, wind farms, biomass plants or other renewable energy assets, you will find fitting investors in our list. As our lists are in a handy Excel format, you can filter them according to your needs: For example in just a few clicks you can identify all wind energy investors based in Germany. Or – German investors with a focus on hydro energy projects.

Different types of green energy investors covered

Our list mainly includes three different types of renewable energy investors: asset- and investment-managers, utilities, and family offices. Asset managers are investing in the name of institutional investors and managing a renewables portfolio for their funds. That includes operating the portfolio, selling the energy through PPAs and on the free market, and acquiring new assets. Utilities are acquiring – and in some cases building on their own – renewable assets to ensure CO2-neutral and cheap energy supply for their customers. Family offices – the investment firms of high net worth families – recently started to invest in renewables and also to acquire wind and solar parks.

Included columns in our database

The list includes all publicly available information or data points shared by the investors themselves. For instance, specific information like installed capacity are only included when stated on the website.

- Company Name

- Legal form

- Stock listed?

- Ticker symbol

- URL

- Country

- City

- Postcode

- Address

- Phone

- LinkedIn Account of C-Level Executives

- Onshore Wind?

- Offshore Wind?

- Solar?

- Hydro?

- Tidal?

- Hydrogen projects?

- Geothermal?

- Energy storage?

- PPA?

- Type of Investor (Asset-/Investmentmanager, Family Office, Utility, IPP (Independent Power Producer))

- Executives

- Regional Focus

- Installed capacity in MW

Picture Source: Karsten Würth & Markus Spiske (25.04.2023)

Reviews

There are no reviews yet.